utah food tax increase 2020

9 2020 Harmons Grocery is joining in opposing the food tax increase from 175 to 485 by opening its 19 statewide stores for people to come in and. Harmons Grocery is joining in opposing the food tax increase from 175 to 485 by opening its 19 statewide stores for people to come in and sign the Utah 2019 Tax.

As Planned Facebook Will Go 100 Renewable Energy Until 2020 New Contract Between Facebook Rocky Mountain Pow Solar Renewable Energy Solar Panel Manufacturers

We appreciate all who have reached out and are grateful for.

. Republican 2020 candidate for Utah Governor Jon Huntsman Jr. You can learn more about how the Utah income tax compares to other states income taxes by visiting our map of income taxes by state. SALT LAKE CITY The Utah State Legislatures tax reform task force has unveiled its bill that would cut income taxes raise food taxes and tax some services.

When it comes to standard deductions in Utah a few differences apply. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah. Exact tax amount may vary for different items The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Utahns experiencing food insecurity and hunger advocates have been vocal about their opposition to the increase which would raise the food tax from 175 to 485 percent saying it could. This graphic shows what this increase means to you. The same bill that cuts the states already low and flat income tax rate from 495 to 466 will also end the discounted sales tax rate the state has for many years charged for.

Counties and cities can charge an. Restaurants that sell grocery food in addition to prepared food may. Heidi Rosenberg of Tooele who works in marketing said she signed the referendum on her way into the store because shes concerned about the impact of the sales.

SALT LAKE CITY Shoppers across Utah are starting to voice concerns about a proposed tax increase to food at the grocery store. 9 2020 Gephardt Daily Harmons Grocery is joining in opposing Utahs food tax increase from 175 to 485 by opening its 19 statewide. West Valley City Utah Jan.

And last updated 934 PM Oct 20 2019. Married couples filing jointly can expect an increase to 24800 for the 2020 tax year which is up 400. Said I initiated tax reform that reduced the sales tax on food when I was governor which has now been.

WEST VALLEY CITY Utah Jan. The Utah County Commission recently voted to adjust property tax rates. Utah has an income tax credit equal to 6 of the.

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Governors Cannot Stop Inflation But Tax And Regulatory Reform Will Boost Their States Economies

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Mexico Tax Rates Taxes In Mexico Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

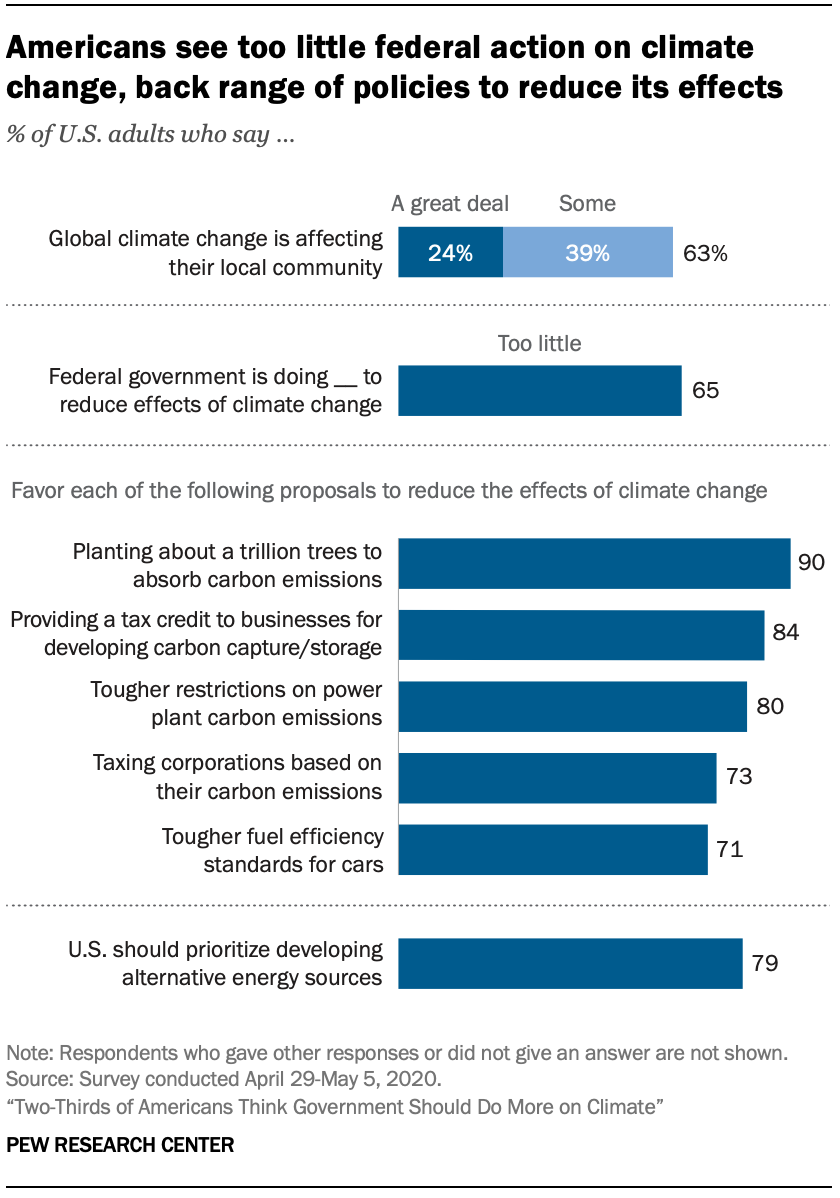

Two Thirds Of Americans Think Government Should Do More On Climate Pew Research Center

Online Sales Tax Compliance Ecommerce Guide For 2022

Learn More Quick Facts On A Fair Tax For Colorado

How Do State And Local Sales Taxes Work Tax Policy Center

Quarterly Sales Tax Rate Changes

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Mexico Tax Rates Taxes In Mexico Tax Foundation