tax incentives for electric cars uk

Financial Year 202122 sees pure. Theres currently zero tax on Benefit in Kind BIK during 2020 2021 for hybrid vehicles with emissions from 1 - 50gkm and a pure electric range of.

Illinois Joins Ny Cali And European Union Uses Tax Incentives To Lure Buyers To Evs Autoevolution

The relevant BIK percentage is applied to the list price of the car which must include the cost of the battery even when this is leased separately by the business.

. Car fuel benefit charge. 655 The tax charge for zero-emission vans increases in 2020-2021 to 80 from 60 of the main rate. Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances.

Company car tax rates start from around nine per cent. Lets explore the EV incentives available in the UK. The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent.

Electric car incentives in the UK and Ireland. On an electric car it would be 0 and next year it would rise to 1 of the sale price. Are electric cars tax deductible UK.

35 of the cost of an electric car up to a maximum of 3000. So if youre a 20-rate taxpayer you pay 20 of 54560 or 10912 a year. 10 of total car sales are made up of alternatively fuelled vehicles.

Other incentives for switching to electric vehicles Vehicle Excise Duty. Incentives did exist for consumer-facing plug-in cars in the UK but as of 14 June 2022 theyve been. An additional incentive scheme allocates 4000 for switching a diesel vehicle of 11 years or more for a new battery electric vehicle BEV.

The Treasury is seeking public input about how to draft regulations that will oversee new and enhanced energy tax benefits ranging from a 7500 consumer credit for. Road Tax is reduced on hybrid vehicles as there are not many. Tax on benefits in kind for electric cars.

That represents a very large personal tax saving. 300 million in grant funding for sales of electric vans taxis and motorcycles to boost drive to net zero. In recent years both the UK and Ireland have implemented incentives to make it more favourable to buy and own electric cars.

However from April 2021 the Government will apply a nil rate for tax to zero. Hybrid vehicles are road taxed according to their CO2 emissions and there are a number of different tax bands. At present there are only 50 electric vehicles registered as company cars out of 11 million company cars on the road.

For the sake of argument say you had a car of the same value but it emitted 170gkm of CO2. This means with electric cars you can deduct. Traditionally employers have been able to offer company cars as.

Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020. 3430 Van fuel benefit charge. Benefit-in-kind tax for electric cars.

Plus there are financial incentives available now to help drivers reduce the price of an EV. EV Incentives in the UK. Are There Tax Incentives For Electric Cars In The United Kingdom.

For a plug-in hybrid electric vehicle. With the Plug-in Car Grant buyers can receive up to. One of the most important incentives for private vehicle owners to go electric is to take advantage of the Plug-In Car Grant which covers up to 2500 of the cars purchase price.

The number of electric cars registered in the UK as of the end of March 2021 was. 24100 Van benefit-in-kind tax charge. Government grants as well as reductions in tax costs aim to make electric motoring.

The government has looked to encourage adoption of pure-eletric and the most efficient plug-in hybrids by dramatically reducing BIK rates for these models. Success in the UKs electric car revolution. Electric cars do not pay road tax.

E V Buying Guide What To Know About Models Batteries Charging And More The New York Times

3 Electric Car Incentives You Need To Know In Europe

Democrats Bill Would Allow Auto Dealers To Claim Clean Vehicle Tax Credits

The Uk Just Eliminated Its Ev Rebate Incentive Engadget

Electric Vehicles Will Be Exempt From Company Car Tax Next Year This Is Money

Electric Vehicle Costs Ev Taxes And Incentives Uk 2021

Road Tax Company Tax Benefits On Electric Cars Edf

The Uk Just Eliminated Its Ev Rebate Incentive Engadget

Proposed Tax Breaks For Electric Cars Look Generous But They Re Complicated Cbs News

Electric Car Tax Credits Explained

A Complete Guide To The Electric Vehicle Tax Credit

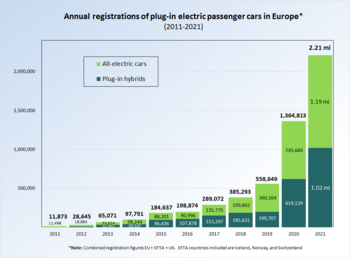

Plug In Electric Vehicles In Europe Wikipedia

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

How To Buy An Electric Car The New York Times

What Are The Tax Incentives For Buying An Electric Vehicle In The Uk And Beyond Zapp Blog Ev News Helpful Resources Opinion

Qualifying Cars For The 2022 Electric Vehicle Tax Credit Verified Org

Federal Tax Breaks Provide Incentives To Buy Electric Vehicles Wlos

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2020 Acea European Automobile Manufacturers Association